Article History Submitted 10 October 2024. Accepted 1 February 2024. Keywords judicial behavior, monetary incentives, corruption, administrative justice, out-of-court arbitration, difference-in-differences |

Abstract We empirically assess how out-of-court monetary rewards influence related in-court judicial behavior. Our analysis provides evidence of the importance of extrinsic motives in the judiciary. In Italy, before a legal reform, Council of State judges were chosen by big law firms to serve as arbitrators in out-of-court arbitrations involving big law firms’ clients. Drawing on case-level data on Council decisions and using a difference-in-differences approach, we establish three central findings. First, before the legal reform, and consistent with the argument that judges strove to compensate big law firms for afforded out-of-court earning opportunities, big law firms were more likely to win Council cases when those cases were presided over by judges with prior arbitration experience. Second, because of a 2010 announcement of an anticorruption law reform that banned judicial participation in arbitrations, big law firms’ winning prospects in Council cases presided by judges with prior arbitration experience decreased by 33.4 percentage points. Third, following the law’s enactment, the success rate of big law firms in these cases converged to the success rate of big law firms in analogous court cases presided by judges without prior arbitration experience. |

|---|

Judges respond to incentives much like everybody else does (Posner 1993). To the extent that monetary incentives are important, they can be deployed to shape and affect judicial decision-making and, eventually, the outcome of litigation. Outright corruption is perhaps the most immediate example,4 but there exist many other more subtle forms of rewarding judicial behavior and thus molding court decisions.5 Not surprisingly, most democracies worldwide have constitutional protections against perturbing judicial salaries and monetary rewards.

In this article, we empirically examine the salience of out-of-court monetary rewards for related in-court judicial behavior, a topic that has received very limited scholarly attention. In the Italian institutional setting that we explore in this research, judges were able to participate in out-of-court assignments such as arbitrating in alternative dispute resolution mechanisms (ADRs hereafter) on top of their regular work in the court. This practice, however, was eventually prohibited under a new law formally enacted in 2012.6 We explore this legal reform to investigate whether, and if so to what extent, judicial participation in ADRs influenced judicial behavior on the bench.

In implementing our empirical analysis, we focus on a set of decisions passed by a specific Italian administrative court that regularly adjudicates cases involving parties represented by big law firms (BLFs hereafter). BLFs are generally more likely than smaller law firms to bring cases before the court in question as well as to participate in ADR arbitration panels where judges were traditionally invited by BLFs to serve as arbitrators. Drawing on appropriate data, we then examine whether judges, who were previously chosen by BLFs to participate in highly rewarding out-of-court ADRs, compensated these law firms with higher rates of success during in-court litigation.

Our analysis, therefore, considers the extent to which out-of-court monetary incentives can shape related in-court judicial behavior. In particular, if allowing judges to participate in ADRs distorts judicial decision-making before the court, then one would also expect that a policy treatment in the form of a legal prohibition on judicial participation in out-of-court affairs such as ADR would mitigate biases arising in in-court judicial behavior.

Our empirical findings suggest that, in Italy, the very announcement of legislation banning judicial participation in ADRthe treatment of our interestprofoundly impacted in-court judicial behavior. Before the treatment, the probability of success of BLFs in court cases presided by judges who previously participated in ADRs was on average nearly 30 percentage points higher than it was in court cases presided by judges without prior ADR participation experience. Strikingly, the treatment then reduced the probability of success of BLFs in court cases presided by judges who previously participated in private ADRs by as much as 33 percentage points on average. After the new law’s announcement and eventual enactment, we observe a re-alignment of the success rate of BLFs in court cases presided by judges with prior ADR appointments to the success rate of BLFs in court cases presided by judges without prior ADR appointments.

The policy implications of our analysis are immediate. Our findings suggest the need for the strengthening of legal provisions that restrict the involvement of public officials in those private undertakings in which the private participating parties also interact with the public officials in their primary public domain.

The paper is structured as follows. Section 2 provides a brief review of the literature, theoretical motivation, and introduction to the institutional context of the Italian case. Section 3 introduces our data. Section 4 presents our empirical approach and results. The final section concludes.

Important literature on the behavior of judges shows that many judicial attributes determine court performance.7 More broadly, the topic of rewarding public officials has been widely discussed in Public Economics. Different compensation schemes have been considered (e.g., flat pay, rewards according to office and merit, and pay for ability).8 Monetary incentives, in line with the arrangement we analyze in this article, have been shown to influence public service performance (Ashraf et al, 2014).9 Monetary incentives are another area of debate in personnel economics (Prendergast, 1999, for a general survey; Gneezy et al, 2011). This literature tends to corroborate the argument that individuals respond to monetary incentives when facing the possibility of enhancing their income by reallocating or distorting decisions. There is no reason to suppose that judges behave differently.10 We advance the existing literature on judicial behavior by examining whether and how out-of-court monetary rewards shape judicial behavior in related in-court situations.

This section specifically analyzes the Council of State (Consiglio di Stato), Italy’s highest court for administrative litigation. In Italy, administrative law is subject to a specialized court structure separate from ordinary judicial courts.11 Overall, the Council of State is composed of a significant majority of career judges, but a few have other legal backgrounds.12 The Council of State is the last appeal court for judgments passed by regional courts.13 It consists of two advising sections (the First and Second Sections), four judicial sections (the Third to Sixth Sections), and an additional advising section (Sezione consultiva degli atti normativi), established in 1997, which advises on legislative and regulatory acts. The composition of each section is reviewed annually. Each section is composed of three Presidents14 and at least twelve judges15 and has jurisdiction over some specific sectors of the public administration. Judges in Italy face mandatory retirement at age seventy (seventy-two until 2014).16

In this article, we focus on the Sixth Section since is the one adjudicating on major administrative litigation, thus more likely to attract business from big law firms. It is also the section that decides the greatest volume of cases at the Council. Furthermore, the Sixth Section deals with a multiplicity of legal issues in administrative law related to several ministries and government authorities.17 Until 2012, judges of this court could carry out external tasks such as arbitrating in alternative dispute resolution mechanisms (ADR).18 To participate in out-of-court ADRs, judges had to receive a nomination and endorsement from participating parties – in particular, the law firms representing those parties. Given the nature of the corporate segment of the market and elite law firms, the choices inevitably reflected the interests of the clients and the big law firms representing them (in this respect, agency costs between corporate clients and big law firms are presumed to be minimal). More specifically, arbitration panels were composed of three members: two arbitrators (appointed by each party and their legal representation) who, in turn, appointed judges of the Council of State to preside over the panel.19

The profitability and thus enticing character of such external tasks is well-documented in mass-media articles published before the law was passed, denouncing the improper, immoral, and possibly corrupt nature of these “extra jobs” taken on by administrative judges and the resulting conflicts of interest. “Sentences are the wife, external tasks the mistress” stated one former President of the Council of State and zealous panel arbiter, while another judge, a later Council President, earned 3.5 times his wage as a judge from arbitrations in 1992.20 As a response to the corresponding malaise and mounting public pressure, the Italian legislature announced a legal reform introducing anti-corruption legislation. The new Anticorruption Law (Legge Anticorruzione, Law No. 190/2012) prohibiting judicial participation in arbitration was formally enacted on November 28, 2012.21 The imminent introduction of the ban, however, was clearly understood and anticipated at least since May 2010, when a bill proposing the banning of judicial participation in arbitration was first introduced in the Italian Senate.22

In conducting our empirical analysis, we therefore focus on the law’s announcement in May 2010, rather than the formal enactment in November 2012, as the treatment of interest. Remarkably, the last authorization of a judicial request to participate in out-of-court arbitration took place in September 2010, soon after the law’s announcement (May 2010) but notably before the law’s formal enactment (end of November 2012). This is evidence that the law’s announcement indeed may have had an important impact on judicial cost-benefit calculus concerning participation in out-of-court arbitration.

In our analysis, we examine the adjudicatory outcomes in Council of State cases before and after the announcement of the Anticorruption Law. We consider a set of Council of State decisions involving the biggest, and thus most influential, Italian law firms involved in decisions passed by the Sixth Section of the Council. Unlike smaller law firms, big law firms (BLFs hereafter) both bring a significant number of cases before the Council.23 At the same time, BLFs participate in out-of-court arbitration cases that were before the legal reform regularly adjudicated by Council judges.24 To shed light on the role of out-of-court rewards for judicial in-court behavior, we examine whether, before the legal reform, there was a connection between judges’ prior appointments to highly rewarding ADRs and the rates of success of BLFs when the latter brought cases before the Council of State.

One straightforward rationale for why such a connection might have existed rests on a rewarding explanation: a higher BLF rate of success in Council cases represents compensation that judges provide to BLFs as quid pro quo for prior appointments to highly rewarding professional activity outside the bench, such as ADR.25 That is, BLFs selected judges as arbitrators in profitable ADRs, and when the opportunity arose, judges compensated BLFs with a higher rate of success in cases decided before the court. Consequently, in the absence of legislation banning judicial participation in ADR, we expect BLFs to have more success in those Council cases that are presided over by judges with a prior record of participation in ADR.

It is important to consider that the rewarding hypothesis reflects an implicit cost-benefit analysis by judges. Arbitration is not a costless option for a judge, both in terms of workload and potential losses of reputation within the judiciary: in a civil law system, the commodification of judicial prestige for private interests is always a contentious matter. In the absence of the legislation banning judicial participation in ADR, many judges would have conceivably perceived a net benefit from arbitration and thus willingly engaged in such out-of-court activity. After the announcement of legislation banning judicial participation in ADR (but before its formal enactment), however, judicial calculus quite plausibly changed, with participation in ADR and rewarding of BLFs becoming comparatively too costly, especially in terms of a judge’s reputation.

The soliciting rationale is a possible alternative account. In the absence of a rule prohibiting judicial participation in ADR, judges accord a higher probability of success in Council cases to BLF in order to be noticed by BLFs and increase the prospects of future appointment to ADRs. Under the corresponding soliciting explanation, judges thus favor BLFs in Council cases not to compensate BLFs but rather to signal their willingness to serve as ADR arbitrators in the future.26 It is important to notice that the legislation banning judicial participation in ADR did not eliminate the possibility that judges could retire early (before seventy) and recoup potential gains in due time (keeping in mind that these are senior judges).

These rewarding and soliciting explanations, however, have different behavioral implications upon the announcement of a legal reform banning judicial involvement in ADRs. Specifically, suppose that, before the legal reform, the success rate of BLFs in Council cases was indeed higher in cases presided over by judges with past ADR experience. Then, under the validity of the rewarding explanation, we should expect that, upon banning judicial participation in ADR, the success rate of BLFs in such cases converges to the success rate of BLFs in analogous cases presided over by other judges. But we should not expect to observe such convergence under the soliciting explanation, since judges can still practice ADR after they retire from the court even in the presence of an anticorruption law.27 We return to the issue of distinguishing between the rewarding and soliciting explanations in Sections 4.1, 4.5, and 4.7.

Last but not least, we emphasize that the legal reform had no known effects on court efficacy, the composition of cases heard by the Council, or judicial retirement strategies. Indeed, court delays remained ubiquitous, and demand for ADR remained stable after the legal reform; if anything, demand for arbitration increased after 2010. Early retirement from the bench did not become common. Similarly, the legal reform may have altered the overall judicial exposure to BLFs. However, there is little reason to believe that, in a civil-law system with generalist judges who necessarily build their human capital slowly, this would have a ready impact on in-court judicial decisions. In fact, available data suggest very little judicial human capital specialization at the Council (also, notice that alternative dispute resolution is mostly about private law whereas judges in the Council apply and enforce administrative law).28 That is, the only plausible channel through which the announcement of the new Anticorruption Law could have affected the success rate of BLFs in Council cases is by altering the connection between judicial opportunity for out-of-court monetary rewards and in-court judicial behavior.

All data concerning judgments pronounced by the Council of State were drawn and coded using the database Leggi d’Italia for the period between June 1, 2006, and May 31, 2014.29 The Council of State decides a vast number of cases every year. To define a tractable sample of representative observations we thus adopt selection criteria. First, we use a legal residence criterion for identifying all the law firms entitled to practice in the Council of State. Second, we use a stepwise procedure to select Council decisions for which either the appellant or the appellee was represented by a law firm that had a reasonably high probability of taking part in ADRs such as arbitrations. We provide details of our sample construction in the appendix.

For each sampled Council case, the following information has been collected: the decision date; the President of the panel deciding the case (President, hereafter); the regional court whose judgment was challenged before the Council of State; the subject area of the judgment; the characteristics of both the appellant and the appellee and their lawyers; and the outcome of the case.

Since individual votes are not public information, our analysis will focus on the sixteen judges who served as Presidents in the relevant period.30 These judges have higher seniority and are typically more experienced than other judges in the court.31 Presumably, they were better able to influence the outcome of the case. They were also more likely appointed as arbitrators.32

Before the Anticorruption Law, judges needed specific authorization to participate in arbitration panels. Accordingly, data on arbitration honoraria have been collected by consulting the lists of external appointments authorized from 2000 onwards. This ensures the inclusion of all arbitrations involving the Sixth Section’s judges in our dataset. Information publicly available on the official website of the Council of State documents that Presidents availed themselves of the opportunity for external reward represented by arbitration appointments.33

Both the authorization date and cumulative honoraria are reported in Table 1 (the sources are detailed in the appendix). For brevity, we include only the information pertaining to the sixteen judges who served as Presidents in the period under analysis. As noted earlier, the last authorization of a judicial request to participate in out-of-court arbitration took place in September 2010, soon after the law’s announcement (May 2010) but notably before the law’s formal enactment (end of November 2012).

For the BLFs included in the dataset, information has been gathered using the registries of the legal professional association in Rome and the National Bar Council (Consiglio Nazionale Forense). This includes the year of birth of the law firm’s leading lawyer and his/her year of admittance to the bar as well as the rate of participation of each big law firm before the Council of State (computed on sampled cases).

| Table 1. Information on Council of State judges. | |||||

|---|---|---|---|---|---|

| Judge (panel President) 1 | Authorization date 1 2 | Authorization date 2 2 | Authorization date 3 2 | Authorization date 4 2 | Total arbitration honoraria (€) 3 |

| 1 | Dec-09 | 45,191 | |||

| 2 | |||||

| 3 | |||||

| 4 | Jun-07 | 20,000 | |||

| 5 | Feb-04 | May-05 | Feb-06 | May-07 | 253,877 |

| 6 | |||||

| 7 | |||||

| 8 | Jun-06 | Feb-10 | 271,146 | ||

| 9 | |||||

| 10 | |||||

| 11 | Apr-02 | Nov-04 | 940,000 | ||

| 12 | |||||

| 13 | Sep-10 | 70,541 | |||

| 14 | Sep-05 | Apr-07 | Dec-08 | May-10 | 2,711,463 |

| 15 | Apr-01 | Jul-03 | Jun-05 | Oct-09 | 1,029,785 |

| 16 | Mar-03 | Mar-04 | Jun-06 | Dec-07 | 56,229 |

1 Total number of judges in the sample: 59; 16 of them acted as panel Presidents (information reported in the table) and 43 of them as Rapporteurs (information not reported in the table, available upon request). 2 Date (mm-yy) of the session of the Council of Presidency which authorized participation in the arbitration proceeding. 3 Cumulative honoraria received from January 1, 2000, to November 28, 2012. Where missing, honoraria have been reconstructed from the value of the claim, using the average share of honorarium/value of the claim computed on available observations. |

|||||

To analyze the impact of the Anticorruption Law on the outcome of cases decided before the Council of State (the Council, in short), we explore the theory/possibility that the change in the law determining the possibility of appointment of judges to arbitration was plausibly exogenous to the outcome of Council decisions. We are interested in investigating whether, and if so to what extent, the announcement of the Anticorruption Law (the treatment of our interest) altered the success rate of BLFs in cases heard in front of the Council and presided by judges with prior arbitration appointments.

Compared to all law firms, BLFs naturally tend to participate in arbitration most often. At the same time, for the Council judges, serving as arbitrators offers an opportunity for profitable compensation. In the absence of an Anticorruption Law that would limit judges in serving as arbitrators, these two facts open the possibility for a mutually beneficial quid pro quo arrangement. Specifically, under the rewarding hypothesis discussed in the previous section, by including judges who regularly preside on panels of cases brought in front of the Council as arbitrators, BLFs can influence the outcomes of the Council's cases. For judges, increasing the prospects of BLF success in cases heard by the Council constitutes a quid-pro-quo for prior arbitration appointments. Thus, all else equal, we would expect the success rate of BLFs in the cases brought in front of the Council to be higher when cases are presided over by judges with a history of participation in arbitration cases.

We use a difference-in-differences (DID) approach to estimate the effect of the change in the law regulating judicial arbitration appointments on the rate of success of BLFs in the (non-arbitration) cases heard by the Council. To define the treatment, we use the announcement date of the Anticorruption Law rather than the date of the law's actual enactment. Our decision is motivated by the fact that the law's announcement provided a credible signal of the law's imminent implementation. As such, the announcement fundamentally shaped the expectations of both the judges and the public.

Our treated group consists of a sample of BLF Council cases decided by panels of judges such that the panel president has previously been appointed for arbitration, according to the selection criterion described in the previous section. However, we do not observe the counterfactual of how BLFs would have fared in cases adjudicated by panel presidents with prior arbitration experience had the ban not been announced in May 2010. Thus, as our control (non-treated) group we use the BLF Council cases decided by panel presidents without prior arbitration experience, again according to the previously illustrated selection procedure. The behavior of those presidents would have been least likely affected by the intended Anticorruption Law. Importantly, for the corresponding set of cases to serve as a good control group, the pattern of the rate of success of BLFs in Council decisions would have to be the same for the treated and the control group of cases in the absence of the announced legal reform.

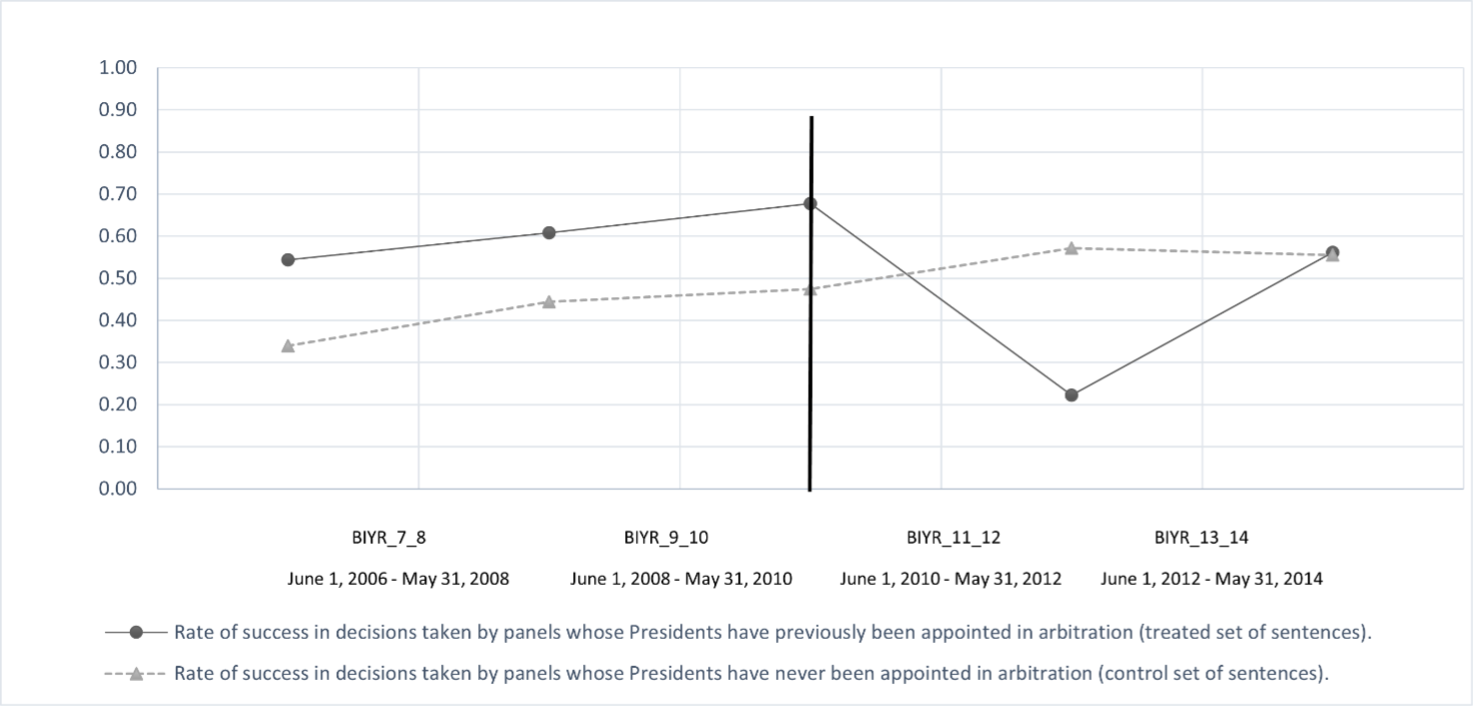

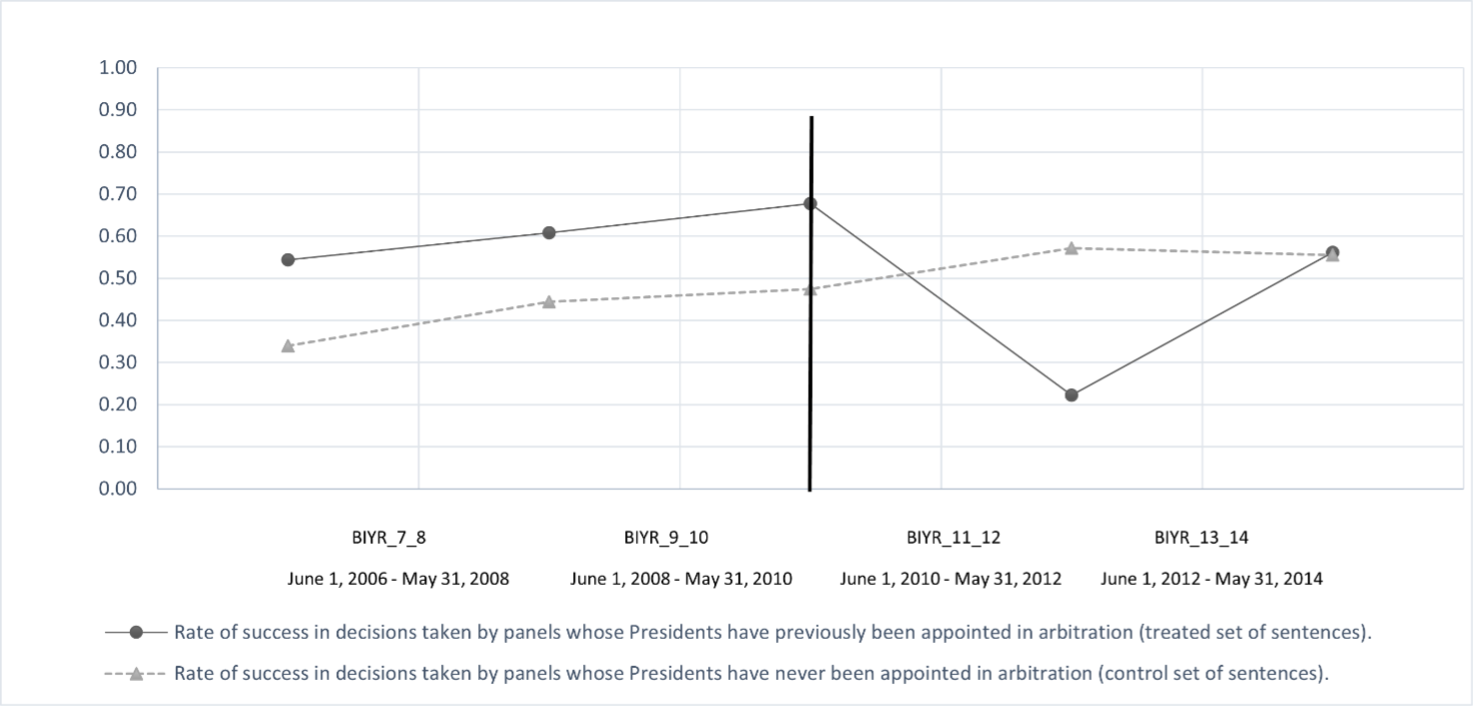

Figure 1 suggests that the key identifying assumption underpinning the DID approach indeed plausibly applies in our context. Before the 2010 announcement of the pertinent law, BLFs’ rates of success in treated and control cases move in a largely parallel fashion.34 Notably, the average success rate of BLFs in treated cases is substantially higher than the success rate of BLFs in control cases.

Figure 1: Rate of success of Big Law Firms: treated and non-treated set of cases. Data on judicial appointments for arbitration have been collected by consulting the lists of external appointments authorized from January 1, 2000.

Figure 1 also shows that the 2010 announcement of the Anticorruption Law induced a sharp decline in the BLFs’ success rate in treated cases relative to the control group of cases. The success rate of BLFs in treated and control cases then converges after 2014, by the end of our observation period. The sharp decline after the law’s announcement is more consistent with the rewarding explanation than with the soliciting explanation. Under the former, the statutory announcement would have elicited a change in judges’ cost-benefit calculus concerning out-of-court behavior, inducing judges to reward BLFs less even before the law was actually enacted. Under the latter, we would not have expected to see a drop in the success rate of BLFs soon after the announcement of the new law, especially given that early retirement and post-retirement opportunities for arbitration were still viable options. At the same time, the decline after the law’s announcement also seems to indicate that the implied judicial rewarding of BLFs is more based on quid-pro-quo interaction between judges and BLFs rather than reflecting personal trust considerations. The latter could not have been impacted so soon upon the announcement of a law banning judicial partaking in arbitration.

We explore the policy change at the moment of announcement, in 2010, to identify the effect of the law prohibiting judicial participation in arbitration. For proper identification, we rely on a bundle of institutional rules that ensure de facto random assignment of cases to panels within the Sixth Section of the Council. In what follows, we detail the time sequence and substantive implications of these rules.

Between 2004 and 2005, the Council of the Presidency (the governing body of the whole administrative judicial system) approved a set of provisions governing the allocation criteria of judges and cases to Administrative Justice panels, stressing the importance of random assignment. These interventions were expressly intended to preclude any possibility for the disputing parties to influence the outcome of the proceedings by interfering in the allocation of the cases.

After a long debate, on February 25, 2005, the Council of the Presidency ruled that judicial panels must be composed based on the principles of equal workload and acquisition of experience.35 In general, cases must be assigned to panels in such a way as to ensure that each judge, including the President and the Rapporteur, intervenes in a fair number of hearings. In addition, judges are required to acquire expertise in all areas of the law in order to avoid exclusive assignment of certain subjects to only a subset of judges.36

In particular, the Council of the Presidency ruled that the titular President of each section is expected to identify homogeneous collections of appeals. Cases are then assigned to panels according to a random alphabet-based (rather than number-based) mechanism.37

Hence, the competence of the judicial sections as related to topics is pre-determined in as much as cases are distributed according to the competence of each section. Judges, including Presidents and Rapporteurs, are assigned to panels according to principles of turnover and equal workload, and a random distribution of cases applies within each section at the panel level.

For our purposes, the random assignment of cases to judges helps limit the possibility that the outcome of cases is influenced by factors such as the judges’ expertise as well any proximate connection between judges and BLFs that might arise if judges who previously participated in arbitration develop a better understanding of the BLF litigation techniques and perspectives on specific types of cases brought before the Council.

In our primary approach, we focus on all Council cases that were heard within four years before or after the May 2010 announcement of the Anticorruption Law (June 1, 2006-May 31, 2014), and that involve a BLF on one side and either the government (central or local) or a private citizen assisted by another law firm on the other side. We estimate a linear probability model as the only framework directly compatible with a regression-based difference-in-differences (DID hereafter) approach. We posit the following baseline specification:

\(\Pr\left( {BLFwin}_{ijt} = 1| \bullet \right) = \alpha + \beta{Post}_{t}{\times PresArb}_{j} + {\gamma Post}_{t} + \ \delta{PresArb}_{j\ } + {\theta X}_{it}\) (1)

where our unit of observation is a Council case i adjudicated by a panel presided by judge j in year t. BLFwinijt is a binary indicator equal to one if in the applicable case the BLF succeeds against its opposing party and zero otherwise. The symbol '⋅' denotes the set of conditioning covariates appearing on the right-hand side of (1). Thus, Postt is a binary indicator equal to one if the case was decided after the announcement of the Anticorruption Law (end of May 2010) and zero if the case was adjudicated before the announcement. PresArbj is a binary indicator equal to one if the judge-president of the panel was ever appointed for arbitration and zero otherwise.\(\ X_{it}\ \)is the vector of case characteristics that include fixed effects for the first instance court, area of law, Rapporteur, and the identity of the opposing party's lawyer (BLF vs other).

The focal coefficient of interest in equation (1) is β, the difference-in-differences (DID) estimate of the impact of the Anticorruption Law on the likelihood of success of BLFs in Council involving a president who had previously been appointed for arbitration judgments. More precisely, β captures the difference between (i) the pre- versus the post-law rate of success of BLFs in Council cases presided by judges with previous arbitration experience (treated cases) and (ii) the analogous change in the success rate of BLFs in Council cases presided by judges who have never previously been appointed for arbitration (control cases).

Our use of a linear probability model by default gives rise to heteroscedastic errors. In addition, in our context, treatment assignment occurs at the level of a presiding judge, giving rise to correlation of unobservables across the decisions of panels presided by a given president. We, therefore, base inference on heteroscedasticity-robust standard errors clustered at the president level. This approach results in 16 clusters. We have investigated the sensitivity of our findings to alternative clustering approaches; the results based on clustering at the president level turned out to be the most conservative and are therefore the only ones we report.38

The results for our baseline specification are reported in Table 2. Column (1) shows the results for the basic DID specification without any additional controls. Based on the corresponding estimates, the announcement of the Anticorruption Law lowered the success rate of BLFs in Council cases involving a president judge with a prior history of arbitration appointments by 33.4 percentage points. The effect is statistically significant at the five-percent level. The estimates further reveal that, before the announcement of the Anticorruption Law, the success rate of BLFs in Council cases was 29.9 percentage points higher in the cases presided by a judge with previous arbitration experience relative to the cases where the presiding judge had not participated in arbitration. Thus, after the May 2010 announcement, there is a convergence in the probability of success of BLFs in cases presided by judges with prior arbitration experience and the probability of success of BLFs in analogous cases presided by judges without prior arbitration experience. This is in line with the evidence visually discernible from Figure 1.

Columns (2)–(7) present the results based on expanded specifications. In column (2) of Table 2, we replace the non-interacted PresArbj dummy with a full set of panel president fixed effects. The inclusion of judge fixed effects fully absorbs the identity of the presiding judge. In columns (3)–(6) we progressively include case-level covariates. Specifically, in column (3), we augment the specification from column (1) by adding Rapporteur fixed effects. In columns (4) and (5) we include dummies for the area of law and identity of the first-instance court, respectively. In column (6) we control for whether the opposing party is also represented by a BLF.

Finally, in column (7) we redefine our treated group as the set of BLF Council cases presided over by judges who previously participated in arbitration more than three times (as opposed to at least once, as in columns (1)–(6) of Table 2). The effect of the announcement of the Anticorruption Law remains statistically significant across all specifications, irrespective of the specific covariates included and the definition of the treated group.

| Table 2. Estimation of the rate of

success of big law firms – DID Baseline model and model with case

covariates Treated set: decisions with Panel presidents who participated in arbitration – Initial date of treatment: May 31, 2010. Dependent variable: BLF success |

||||||||

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | |

| Post×Pres_Arb | -0.334** (0.129) |

-0.608* (0.316) |

-0.597* (0.293) |

-0.165** (0.0689) |

-0.172*** (0.0484) |

-0.178* (0.0935) |

-0.291** (0.126) |

-0.607* (0.274) |

| Post | 0.162 (0.121) |

0.196 (0.278) |

0.0824 (0.137) |

0.0814 (0.0856) |

0.0356 (0.0393) |

0.00836 (0.0943) |

0.162 (0.121) |

0.283 (0.213) |

| Pres_Arb | 0.299** (0.0998) |

0.292* (0.160) |

0.103* (0.0525) |

0.128*** (0.0377) |

0.164** (0.0567) |

0.255** (0.0939) |

0.369*** (0.0790) |

|

| President FE | yes | |||||||

| Rapporteur FE | yes | |||||||

| Area of Law dummies | yes | |||||||

| First-Instance Court dummies | yes | |||||||

| Other party represented by BLF dummy | yes | |||||||

| Constant | 0.351*** (0.0925) |

0.484*** (0) |

0.372 (0.267) |

0.485*** (0.0905) |

0.501*** (0.0342) |

0.594*** (0.0895) |

0.351*** (0.0929) |

0.289** (0.0790) |

| Observations | 710 | 710 | 710 | 710 | 710 | 710 | 627 | 429 |

| R-squared | 0.066 | 0.125 | 0.271 | 0.191 | 0.182 | 0.171 | 0.038 | 0.054 |

Notes: Linear probability model: baseline and with case covariates. Standard errors clustered at the President level in parentheses. *** p<0.01, ** p<0.05, * p<0.1 Decisions/observations refer to the period June 1, 2006 – May 31, 2014. Post = 1 from May 31, 2010, to May 31, 2014; except column (8) which refer to the period June 1, 2008 - May 31, 2012 (Post = 1 from May 31, 2010, to May 31, 2012). Dependent variable (BLFwinijt) = 1 if in the applicable case the BLF succeeds against its opposing party and zero otherwise. Column (1)–(6): Treated set of decisions (Pres_Arb =1) includes those where Presidents had at least 1 arbitration appointment. Column (7): Treated set of decisions (Pres_Arb =1) includes those where Presidents had at least 3 arbitration appointments. Column (8): Treated set of decisions (Pres_Arb =1) includes those where Presidents had at least 1 arbitration appointment (smaller bandwidth). Data on judicial appointments for arbitration have been collected by consulting the lists of external appointments authorized from January 1, 2000. |

||||||||

One concern about our baseline estimates might be that they perhaps reflect the effect of some presiding judge characteristics other than whether the presiding judge has participated in arbitration. To address this concern, we estimate a series of specifications where we include a vector of presiding judge-level covariates, \(W_{jt}\), and their interactions with the Postt dummy:

\[\Pr\left( {BLFwin}_{ijt} = 1| \bullet \right) = \alpha + \beta{Post}_{t}{\times PresArb}_{j} + {\gamma Post}_{t} + \ \delta{PresArb}_{j\ } +\]

\({\theta X}_{it} + \chi W_{jt} + \kappa^{'}{Post}_{t} \times W_{jt}\) (2)

The inclusion of these additional judge-level controls and their interactions with the Postt dummy is intended to mitigate the concern that the identity of a judge as a panel president may be correlated with other judge characteristics not accounted for in our baseline specification. As components of \(W_{jt}\) we include the age of the president and the year when he or she was admitted to either administrative justice or joined the Council. The interactions between the Postt and \(W_{jt}\) then ensure that any estimate of the coefficient on the interaction term between Postt and PresArbj is not spuriously reflecting the impact of some judge-case level factor other than the judge's identity as a president of a panel that is most relevant to the treatment.39

The results based on the estimation of the corresponding specifications are reported in Table 3 that features an otherwise-analogous set of specifications as Table 2. The central finding is that upon controlling for presiding judge-level, covariates, and their interactions with the Postt dummy, we continue to see robust evidence of a negative effect of the Anticorruption Law on the prospects of BLF success in cases presided by judges with prior arbitration experience.

In addition, the estimates in Table 3 reveal no clear relationship between judicial age and BLF success rate. In particular, neither the coefficient on the variable Pres_birth before the law’s announcement (when Post equals zero) nor the implied effect of Pres_birth after the law’s announcement (sum of estimated coefficients on Pres_birth and Post×Pres_birth) is ever negative and statistically significant. This finding does not lend support to the soliciting explanation under which judges born earlier, and thus nearing retirement, should be more eager to ensure BLF success both before and after the statutory announcement.

| Table 3. Estimation of the rate of success of big law firms – DID including President characteristics. Treated set: decisions with Panel presidents who participated in arbitration – Initial date of treatment: May 31, 2010 | |||||||

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | |

| Post×Pres_Arb | -0.303** (0.122) |

-2.562*** (0.692) |

-0.142** (0.0545) |

-0.192** (0.0823) |

-0.242*** (0.0742) |

-0.211** (0.0705) |

-2.837* (1.599) |

| Post | 64.75 (53.09) |

-264.8* (141.4) |

-9.669 (23.99) |

-6.422 (12.12) |

-22.77 (27.33) |

-23.04 (21.79) |

-256.7 (343.4) |

| Pres_Arb | 0.283** (0.122) |

-0.308* (0.143) |

0.106* (0.0509) |

0.103*** (0.0294) |

0.159** (0.0632) |

0.0703* (0.0318) |

0.242*** (0.0890) |

| Pres_birth | -0.0106 (0.0116) |

0.0501** (0.0204) |

-0.00796 (0.00638) |

0.00155 (0.00684) |

-0.00553 (0.00633) |

-0.00505 (0.00336) |

0.00798 (0.00682) |

| Post×Pres_birth | 0.0113 (0.0151) |

0.103*** (0.0319) |

0.00674 (0.0113) |

0.00331 (0.00624) |

0.0117 (0.0140) |

0.0119 (0.0112) |

0.0981 (0.0810) |

| Pres_adm_justice | -0.0429*** (0.00482) |

0.00241 (0.0376) |

-0.0253*** (0.00763) |

0.0162*** (0.00520) |

-0.0169 (0.0116) |

-0.0453*** (0.00498) |

-0.0383*** (0.00776) |

| Post× Pres_adm_justice |

0.0504** (0.0178) |

0.125 (0.168) |

0.0232 (0.0169) |

-0.0166 (0.0207) |

0.0288 (0.0240) |

0.0528** (0.0173) |

0.182 (0.201) |

| Pres_council | 0.0112 (0.0119) |

-0.0310 (0.0313) |

0.00826** (0.00331) |

-0.00634* (0.00305) |

0.00552 (0.00344) |

0.0481*** (0.00282) |

0.0383*** (0.00805) |

| Post×Pres_council | -0.0436* (0.0227) |

0.0326 (0.0436) |

-0.0372*** (0.0119) |

-0.0162 (0.0165) |

-0.0484* (0.0258) |

-0.0804*** (0.0163) |

0.0336 (0.101) |

| Rapporteur FE | yes | ||||||

| Area of Law dummies |

yes | ||||||

| First-Instance Court dummies | yes | ||||||

| Other party represented by BLF dummy | yes | ||||||

| Constant | -1.385 (34.22) |

-35.36 (31.32) |

1.249 (14.09) |

10.60 (10.15) |

1.593 (14.39) |

-79.14*** (7.590) |

-91.25*** (19.99) |

| Observations | 710 | 710 | 710 | 710 | 710 | 627 | 429 |

| R-squared | 0.082 | 0.275 | 0.196 | 0.184 | 0.174 | 0.098 | 0.112 |

Notes: Linear probability model: baseline and with case and President covariates. Standard errors clustered at the President level in parentheses. *** p<0.01, ** p<0.05, * p<0.1 Decisions/observations refer to the period June 1, 2006 – May 31, 2014. Post = 1 from May 31, 2010, to May 31, 2014; except column (8) which refer to the period June 1, 2008 – May 31, 2012 (Post = 1 from May 31, 2010 to May 31, 2012). Column (2) was not replicated from Table 2 due to collinearity between President Fixed-Effects and personal characteristics of the judges (covariates). Column (1)–(5): Treated set of decisions (Pres_Arb =1) includes those where Presidents had at least 1 arbitration appointment. Column (6): Treated set of decisions (Pres_Arb =1) includes those where Presidents had at least 3 arbitration appointments. Column (7): Treated set of decisions (Pres_Arb =1) includes those where Presidents had at least 1 arbitration appointment (smaller bandwidth). Data on judicial appointments for arbitration have been collected by consulting the lists of external appointments authorized from January 1, 2000. |

|||||||

Our baseline estimates evaluate the average effect of the law's announcement. We next allow for a more flexible specification and evaluate the dynamic effects. The resulting approach also allows us to investigate any unwanted pre-trends in the data using a statistical test, beyond the visual inspection of Figure 1. To this end, we specify the following equation:

\(\Pr\left( {BLFwin}_{ijt} = 1| \bullet \right) = \alpha + \sum_{\tau}^{}\beta_{\tau}{BIYR}_{\tau}{\times PresArb}_{j} + \ \gamma{PresArb}_{j\ } + \lambda_{t} + {\theta X}_{it}\) (3)

where \({BIYR}_{\tau}{\times PresArb}_{j}\) are the interactions between the indicator for a President’s appointment in arbitration and dummies for the following two-year periods (BIYR): June 1, 2006–May 31, 2008 (BIYR_7_8); June 1, 2010–May 31, 2012 (BIYR_11_12); and June 1, 2012–May 31, 2014 (BIYR_13_14). The correspondingly defined two-year periods are defined relative to the month-year of the law’s announcement. For identification, we omit the dummy for the two-year period immediately preceding the treatment, that is, June 1, 2008-May 31, 2010 (BIYR_9_10). The remaining elements of expression (3) are as defined under expression (1). According to equation (3), the biyear fixed effects λt fully absorb the timing of the decision date relative to the timing of the announcement of the imminent introduction of the law, rendering a separate inclusion of Postt on the right-hand side of (3) redundant.

The results based on the estimates from the dynamic specification are reported In Table 4. Each column shows the results for a different bandwidth. In Table 4, we report the baseline outcome, progressively varying the time bandwidth defining our sample. Column (1) shows the results for the largest bandwidth (June 1, 2006 – May 31, 2014). Columns (2)–(4) show the results when we restrict the bandwidth to August 1, 2006 – March 31, 2014; October 1, 2006 – January 31, 2014; and December 1, 2006 – November 31, 2013, respectively.

The estimates show a persistent negative effect of the announcement of the Anticorruption Law on the prospects of success of BLFs in cases presided over by judges with prior arbitration experience. Based on the estimates in column (1), the law’s negative effect on the likelihood of success of BLF is especially pronounced in the first two years after the law’s announcement (51.5 percentage points) and subsequently decreases in magnitude (15.2 percentage points) but does not altogether dissipate. The difference between the effects at the two time horizons is statistically significant (p-value for the test of equality of pertinent coefficients equals is smaller than 0.001). An exactly analogous pattern of findings emerges based on the estimation of specifications with a narrower bandwidth (see columns (2)-(4) of Table 4)40.

Importantly, the estimates in Table 4 also show that our data exhibit no pre-trends. The coefficient on the interaction term between the dummy for the earliest biyear period (BIYR_7_8) and the dummy for the presiding judge with a prior arbitration experience (PresArb) is not statistically significantly different from zero in any of the featured specifications. This is further evidence in favor of the applicability of the DID design in our context.

| Table 4 Estimation of the rate of success of big law firms – DID Dynamic model. Treated set: decisions with Panel presidents who participated in arbitration – Initial date of treatment: May 31, 2010. Dependent variable: BLF success | ||||

| (1) | (2) | (3) | (4) | |

| Explanatory vars \ Time-span | June 1, 2006 – widest time-span |

Aug 1, 2006 – March 31, 2014 intermediate-wide time-span |

Oct 1, 2006 – intermediate-narrow time-span |

Dec 1, 2006 – narrow time-span |

BIYR_7_8× Pres_Arb June 1, 2006-May 31, 2008 |

-0.138 (0.163) |

-0.00134 (0.232) |

-0.0825 (0.236) |

-0.0482 (0.268) |

BIYR_11_12× Pres_Arb June 1, 2010-May 31, 2012 |

-0.515** (0.178) |

-0.523** (0.183) |

-0.525** (0.192) |

-0.573** (0.213) |

BIYR_13_14× Pres_Arb June 1, 2012-May 31, 2014 |

-0.152* (0.0708) |

-0.180* (0.095) |

-0.200* (0.101) |

-0.295** (0.115) |

| Pres_Arb | 0.153** (0.0553) |

0.149** (0.0621) |

0.157** (0.0602) |

0.162** (0.0602) |

| Biyear FE | yes | yes | yes | yes |

| Constant | 0.651*** (0.0995) |

0.623*** (0.100) |

0.612*** (0.104) |

0.606*** (0.103) |

| Observations | 710 | 649 | 633 | 603 |

| R-squared | 0.254 | 0.018 | 0.021 | 0.014 |

Notes: Linear probability model. Standard errors clustered at the President level in parentheses. *** p<0.01, ** p<0.05, * p<0.1 Treated set of decisions (Pres_Arb =1) are those whose Presidents had at least 1 arbitration appointment. Column (1): BIYR_7_8 to BIYR_13_14 (BIYR FE) refer to 2-year periods, respectively: June 1, 2006-May 31, 2008 (BIYR_7_8); June 1, 2008-May 31, 2010 (BIYR_9_10, omitted category); June 1, 2010-May 31, 2012 (BIYR_11_12); June 1, 2012-May 31, 2014 (BIYR_13_14). Column (2): BIYR_7_8 starts on Aug 1, 2007, and BIYR_13_14 ends on March 31, 2013. Column (3): BIYR_7_8 starts on Oct 1, 2007, and BIYR_13_14 ends on Jan 31, 2013. Data on judicial appointments for arbitration have been collected by consulting the lists of external appointments authorized from January 1, 2000. |

||||

Which of the two competing hypotheses, rewarding versus soliciting, is a comparatively better explanation for our empirical results? Figure 1 and the estimates based on the dynamic specification suggest that the prospects of success of BLFs in treated and control cases converge over time. Because retired judges can continue to participate in arbitration even after the enactment of the Anticorruption Law, this evidence does not support the soliciting hypothesis. Under the soliciting hypothesis, the judges should continue favoring BLFs even after 2010 to improve their prospects of future, post-retirement appointments to arbitration. But this is not what we see in the data. In addition, as argued in Section 4.5, we do find evidence of a relationship between the panel president’s age and BLF success that we have expected to observe under the validity of the soliciting explanation.

We also provide an additional empirical test of the validity of the soliciting hypothesis. Under the latter, a judge’s past record of relatively high success rates of BLFs should increase the likelihood of subsequent arbitration appointments. To evaluate this hypothesis, we would ideally possess data on the arbitration appointments of retired judges after the passage of the Anticorruption Law. Unfortunately, such data are not available to us. As a second best, we use the data utilized in the analysis in the previous sections and posit the following linear probability model:

\(\Pr\left( {AppointArb}_{ijt} = 1| \bullet \right) = \beta_{0} + \beta_{1}{\overline{BLFwin}}_{j,t - 1} + \beta_{2}{AppointArb}_{ij,t - 1} + {\theta X}_{it}\) (4)

The outcome variable, \({AppointArb}_{ijt}\), is a dummy equal to one if judge j presiding over a current Council case i is appointed to arbitration within a year from the resolution of the applicable case. The key explanatory variable, \({\overline{BLFwin}}_{j,t - 1}\), is the average success rate of BLFs in Council cases presided by judge j in the year before the decision on current case i.41 If the soliciting hypothesis is a salient explanation for our results, then we would expect the estimate of \(\beta_{1}\)to be positive: a higher success rate of BLFs in Council cases should improve the presiding judge’s future prospects of appointment to arbitration.

The expression (4) also features controls. To account for possible over-time dependence in judicial appointments to arbitration, we include the variable \({AppointArb}_{ij,t - 1}\), an indicator equal to one if judge j presiding over the current case i was appointed for arbitration in the year before the decision on the current case i. A positive \(\beta_{2}\) may indicate that a judge’s past performance in arbitration has been rewarded with a subsequent appointment. A negative \(\beta_{2}\) would indicate that a past arbitration appointment lowers the prospects of a future arbitration appointment. Finally,\(\ X_{it}\ \)is the vector of case characteristics as introduced in Section 4.3.

The estimates of the key parameters corresponding to equation (4) are reported in Table 5. Each column shows a different specification based on the included elements of the vector of controls \(X_{it}\). The central finding that emerges is that, irrespective of the specification, the estimate of \(\beta_{1}\) is never statistically significantly different from zero. We thus do not find evidence that the likelihood of future arbitration appointment is statistically significantly related to the presiding judge’s prior record of BLF success in Council cases. Our data therefore do not lend support to the soliciting hypothesis as an explanation for our key empirical result.

In addition, the estimates show that the prospects of future arbitration appointments are positively related to the incidence of a past arbitration appointment. Thus, before the announcement of the Anticorruption Law, a judge’s past participation in arbitration appears to generally have promoted further arbitration appointments in the future.

| Table 5. Estimation of the likelihood that Panel presidents were appointed in arbitration before Anti-corruption Law: Soliciting hypothesis. Dependent variable: Judge president appointed to arbitration at t (\(AppointArb\)ijt) | ||||||

| Explanatory vars | (1) | (2) | (3) | (4) | (5) | (6) |

| \[{\overline{BLF\_ win}}_{it - 1}\] | 0.320 (0.205) |

0.350 (0.313) |

0.280 (0.228) |

0.303 (0.217) |

0.366 (0.291) |

0.337 (0.209) |

| \(AppointArb\)ijt-1 | 0.525** (0.206) |

0.895*** (0.106) |

0.472** (0.180) |

0.503** (0.165) |

0.497** (0.202) |

|

| President FE | yes | |||||

| Rapporteur FE | yes | |||||

| Area of Law dummies | yes | |||||

| First-Instance Court dummies | yes | |||||

| Other party’s Lawyer is BLF dummy | yes | |||||

| Constant | -0.111 (0.0781) |

-0.00729 (0.00651) |

0.0216 (0.0784) |

-0.0714 (0.0783) |

-0.0333 (0.0635) |

-0.0664 (0.0675) |

| Observations | ||||||

| R-squared | 710 | 710 | 710 | 710 | 710 | 710 |

Notes: Linear probability model: baseline and with case covariates. Standard errors clustered at the President level in parentheses. *** p<0.01, ** p<0.05, * p<0.1 Dependent variable (\({PAPpoinArb}_{ijt}\)) equals 1 if the President of the panel deciding over a given dispute is appointed in arbitration. \({\overline{BLFwin}}_{it - 1}\) corresponds to the average success rate accorded to big law firms by the President in the 12 months prior to the decision. Data on judicial appointments for arbitration have been collected by consulting the lists of external appointments authorized from January 1, 2000. |

||||||

We conducted a robustness check to rule out the possibility that our findings are driven by the behavior of a particular judge. Indeed, the data in Table 1 seem to indicate a considerable heterogeneity in the Presidents’ honoraria from arbitrations. In addition, some judges presided over more panels than others. We, therefore, re-estimated our baseline DID specification from Table 2, column (1), upon dropping, one set at a time, the cases adjudicated by each individual presiding judge. The results are reported in Table A.1 in the Appendix. The DID estimate of the coefficient of interest remains negative and statistically significant irrespective of which presiding judge and their Council cases are dropped from the sample.

We have empirically investigated whether, and if so to what extent, monetary out-of-court rewards influence related judicial in-court behavior. To this end, we focused on the activity of the Italian Council of State, a major Italian administrative tribunal. We considered the cases brought before the Council by big law firms (BLFs), that is, law firms that often appear before the Council and are also frequently involved in external arbitrations. We then performed difference-in-differences analysis where the treatment of our interest was the 2010 announcement of an imminent anticorruption legal reform prohibiting judicial involvement in private out-of-court arbitration.

Our findings show that, prior to the announcement of the Anticorruption Law, BLFs were more likely to win when their cases were adjudicated by judges who had previously been appointed for lucrative out-of-court arbitrations. The law’s announcement, however, substantially reduced the prospects of BLF success in those cases. Our analysis therefore suggests that, in the pre-reform era, judges who had been given the opportunity to participate in out-of-court arbitrations tended to reward BLFs by increasing BLF winning prospects when the BLFs found themselves representing parties before the court. Our findings are not consistent with the alternative hypothesis, that judges favored BLFs in order to increase their chances of future appointment to arbitrations.

Our goal has been to investigate the empirical salience of monetary incentives as a factor shaping judicial behavior, as opposed to assessing the effectiveness of judicial anticorruption measures. But our analysis also provides strong empirical support in favor of legal provisions that limit the involvement of public officials in external activities and tasks. Our evidence reveals that, after the enactment of the Anticorruption Law, the success rate of BLFs in court cases presided by judges who had previously been appointed to arbitrations converged with the success rate of BLFs in analogous court cases presided by judges without prior arbitration appointments. That is, the ban on participation in arbitration appears to have been quite successful at alleviating judicial biases in administrative litigation.

While our inquiry has focused on the behavior of judges of the Italian Council of State court, the implications of our analysis extend far beyond the Italian borders. First, judicial biases and corruption are a concern worldwide, and Italian institutions are broadly representative of the institutions in many civil law jurisdictions. Second, our analysis speaks to the under-investigated relationship between judicial behavior and monetary incentives, as opposed to the functioning of arbitrations or the particularities of a specific court. Finally, our results show that extrinsic motives matter not only outside the legal system, but, importantly, also for judicial behavior.

An earlier version of this article was circulated with a different title, Monetary Rewards and Behavior: An Empirical Investigation of the Judiciary. We wish to thank two anonymous referees, Decio Coviello, Gabriel Doménech, Greg De Angelo, Susan Franks, Eric Helland, Daniel Klerman, Jonathan Klick, Weijia Rao, Holger Spamann, Nicola Persico, JJ Prescott, and Keren Weinshall for helpful comments. We also thank participants at the 2014 SIDE-ISLE Conference-Rome, 2015 EALE Conference-Vienna, 2018 The Economics of Judicial Productivity workshop (Strasbourg, France), Norwegian School of Economics at Bergen and University of Paris II seminars for comments on that earlier version of the article. This version of the article was presented at CELS-2022 Conference-UVA. We are indebted to Alessio Liberati for insightful suggestions throughout this research and to Mattia Suardi for his extremely valuable involvement in the earlier stages of the project. Lucia dalla Pellegrina wishes to thank the Baffi-CAREFIN Center at Bocconi University for generous financial support. We are grateful to Madeline Conn for excellent research assistance. The usual disclaimers apply.

Aney, Madhav S, Shubhankar Dam, and Giovanni Ko. 2021. ”Jobs for Justice(s): Corruption in the Supreme Court of India.” Journal of Law and Economics 64: 479–509. https://doi.org/10.1086/713728

Ash, Elliott and W. Bentley MacLeod. 2015. “Intrinsic Motivation in Public Service: Theory and Evidence from State Supreme Courts.” Journal of Law and Economics 58(4): 863–913. https://doi.org/10.1086/684293

Ashenfelter, Orley. 1987. “Arbitrator Behavior.” American Economic Review 77:342–346.

Ashenfelter, Orley and David E. Bloom. 1984. “Models of Arbitrator Behavior: Theory and Evidence.” American Economic Review 74(1): 111–124.

Ashraf, Nava, Oriana Bandiera, B. Kelsey Jack. 2014. “No Margin, No Mission? A Field Experiment on Incentives for Public Service Delivery.” Journal of Public Economics 120: 1–17. https://doi.org/10.1016/j.jpubeco.2014.06.014

Bagues, Manuel and Berta Esteve-Volart. 2014. “Performance Pay and Judicial Production: Evidence from Spain.” http://www.manuelbagues.com/bagues%20&%20esteve-volart%20-%20judges.pdf

Banuri, Sheheryar and Philip Keefer. 2015. “Was Weber Right? The Effects of Pay for Ability and Pay for Performance on Pro-Social Motivation, Ability and Effort in the Public Sector.” World Bank Policy Research, working-paper 7621. https://doi.org/10.1596/1813-9450-7261

Bloom, David E. 1986. “Empirical Models of Arbitrator Behavior under Conventional Arbitration.” Review of Economics and Statistics 68: 578–585.

Bloom, David E. and Christopher L. Cavanagh. 1986. “An Analysis of the Selection of Arbitrators.” American Economic Review 76(3): 408–422.

Bray, Robert L., Decio Coviello, Andrea Ichino, and Nicola Persico. 2016. “Multitasking, Multiarmed Bandits, and the Italian Judiciary.” Manufacturing & Service Operations Management 18(4): 545–558. https://doi.org/10.1287/msom.2016.0586

Coviello, Decio, Andrea Ichino, and Nicola Persico. 2019. “Measuring the Gains from Labor Specialization.” Journal of Law and Economics 62: 403–426. https://doi.org/10.1086/704244

DeAngelo, Gregory and Bryan C. McCannon. 2017. “Judicial Compensation and Performance.” Supreme Court Economic Review 25: 129–147. https://doi.org/10.1086/699661

de Clippel, Geoffroy, Kfir Eliaz, and Brian Knight. 2014. “On the Selection of Arbitrators.” American Economic Review 104(11): 3434–3458. https://doi.org/10.1257/aer.104.11.3434

de Figueiredo, Miguel F.P., Alexandra D. Lahav, and Peter Siegelman. 2020. “The Six-Month List and the Unintended Consequences of Judicial Accountability.” Cornell Law Review 105: 363–456.

Epstein, Lee and Jack Knight. 2013. “Reconsidering Judicial Preferences.” Annual Review of Political Science 16(1): 11–31. https://doi.org/10.1146/annurev-polisci-032211-214229

Frey, Bruno and Felix Oberholzer-Gee. 1997. “The Cost of Price Incentives: An Empirical Analysis of Motivation Crowding-out.” American Economic Review 87(4): 746–755.

Furlan, Federico. 2012. “Gli incarichi extragiudiziari dei magistrati amministrativi: problemi e prospettive.” Quaderni Costituzionali 11–13.

Garoupa, Nuno, Marian Gili, and Fernando Gómez-Pomar. 2012. “Political Influence and Career Judges: An Empirical Analysis of Administrative Review by the Spanish Supreme Court.” Journal of Empirical Legal Studies 9(4): 795–826. https://doi.org/10.1111/j.1740-1461.2012.01270.x

Gneezy, Uri, Stephan Meier and Pedro Rey-Biel. 2011. “When and Why Incentives (Don’t) Work to Modify Behavior.” Journal of Economic Perspectives 25: 191–209. https://doi.org/10.1257/jep.25.4.191

Hasnain, Zahid, Nick Manning, and Henryk Pierskalla. 2012. “Performance-related Pay in the Public Sector: A Review of Theory and Evidence.” World Bank Policy Research, working-paper 6043.

Heinrich Carolyn J. and Gerald Marschke. 2010. “Incentives and their Dynamics in Public Sector Performance Management Systems.” Journal of Policy Analysis and Management 29(1): 183–208. https://doi.org/10.1002/pam.20484

Ichino, Andrea, Michele Polo, and Enrico Rettore. 2003. “Are Judges Biased by Labor Market Conditions?” European Economic Review 47(5): 913–944. https://doi.org/10.1016/S0014-2921(02)00269-6

Jia, Ruixue, and Huihua Nie. 2017. “Decentralization, Collusion, and Coal Mine Deaths.” Review of Economics and Statistics 99 (1): 105–118. https://doi.org/10.1162/REST_a_00563

Kang, Michael S. and Joanna M. Shepherd. 2015. “Partisanship in State Supreme Courts: The Empirical Relationship between Party Campaign Contributions and Judicial Decision Making.” Journal of Legal Studies Volume 44(S1): S161–S185, https://www.journals.uchicago.edu/doi/10.1086/682690

Klerman, Daniel. 2007. “Jurisdictional Competition and the Evolution of the Common Law.” University of Chicago Law Review 74: 1179–1226.

Klerman, Daniel and Greg Reilly. 2016. “Forum Selling.” Southern California Law Review 89(2): 241–316.

Kreps, David M. 1997. “Intrinsic Motivation and Extrinsic Incentives.” American Economic Review 87: 359–364.

Posner, Richard. 1993. “What Do Judges and Justices Maximize? (The Same Thing Everybody Else)” Supreme Court Economic Review 3: 1–41.

Posner, Richard. 2005. “Judicial Behavior and Performance: An Economic Approach.” Florida State University Law Review 32: 1259–1279.

Posner, Richard. 2008. How Judges Think. Cambridge, MA: Harvard University Press.

Prendergast, Canice. 1999. “The Provision of Incentives in Firms.” Journal of Economic Perspectives 7: 7–63. https://doi.org/10.1257/jel.37.1.7

Prendergast, Canice. 2007. “The Motivation and Bias of Bureaucrats.” American Economic Review 97: 180–196. https://doi.org/10.1257/aer.97.1.180

Prendergast, Canice. 2008. “Intrinsic Motivation and Incentives.” American Economic Review 98: 201–205. https://doi.org/10.1257/aer.98.2.201

University of Milano-Bicocca, lucia.dallapellegrina@unibocconi.it, https://orcid.org/0000-0002-3648-7506.↩︎

George Mason University, ngaroup@gmu.edu, https://orcid.org/0000-0001-6792-0918 (corresponding author).↩︎

Washington and Lee University, grajzlp@wlu.edu, https://orcid.org/0000-0003-3721-3299.↩︎

For example, see Aney et al (2021) for the case of corruption in the Supreme Court of India.↩︎

Some experiences with performance measures and monetary awards have documented how judges adjust to incentives, for instance, Bagues and Esteve Volart (2014). There is also scholarship studying judicial incentives in settings where electoral campaigns must be financed, as is the case in many states in the United States; see Kang and Shepherd (2015).↩︎

This new law (Law No. 190/2012) had a more general aim – to restrain corruption and misconduct within public administration in Italy.↩︎

Posner (1993 & 2005 & 2008), Ichino et al (2003), and Epstein and Knight (2013). Also, for example, FSU Symposium on Judicial Performance (2005). DeAngelo and McCannon (2017) demonstrate that higher judge salaries induce higher quality decisions. Other recent literature has focused on court management issues and judicial responses, including strategic adjustments, gaming and peer effects—Bray et al (2016), de Figueiredo et al (2020), and Coviello et al (2019) among others. They show that appropriate incentives can be used to shape judicial behavior in ways that enhance efficient court management (particularly, delay and appeal rates). At the same time, some forms of external accountability can have unforeseen effects on caseload and court management (by enhancing strategic manipulation of court delay). Counterbalancing the discussion on judicial salaries and monetary rewards, there is also growing literature on intrinsic motivation in the courts, presenting empirical results consistent with the idea that intrinsically motivated judges provide high quality decisions—Ash and MacLeod (2015). On the importance of forum shopping, jurisdictional competition, and extrinsic motivation, see Klerman (2007) and Klerman and Reilly (2016). A large body of literature on judicial performance indicators at the aggregate level (based on empirical studies by the World Bank, Council of Europe, and OECD) which is to a large extent unrelated to our analysis.↩︎

The shortcomings of pay-for-performance in the public sector have been recognized regarding significant monitoring costs and a reduction of intrinsic motivation to exert effort—Frey and Oberholzer-Gee (1997), Kreps (1997), Prendergast (2008).↩︎

However, there is no consensus about which pay scheme is more effective in attracting high-quality human capital and incentivizing performance—Prendergast (2007), Heinrich and Marschke (2010), Hasnain et al (2012) and Banuri and Keefer (2015).↩︎

There is a vast theoretical, empirical, and experimental literature on motivations of arbitrators. Professional reputation and extrinsic motivation matter. See seminal articles by Ashenfelter and Bloom (1984), Bloom (1986), Bloom and Cavanagh (1986), Ashenfelter (1987), and, more recently, de Clippel et al. (2014).↩︎

There exist two judicial levels of administrative review: regional courts (Tribunali amministrativi regionali, TARs) and Consiglio di Stato (Council of State). Judges (Magistrati Amministrativi) in regional courts are career magistrates, although formally distinct from ordinary judges. The twenty regional courts act as courts of first instance, which deal with administrative law cases according to territorial competence. The regional court of Lazio, based in Rome, has general jurisdiction over cases involving central administrative bodies, except for those acts whose effects are limited to the territory of the relevant region (in which case, the competent body is the local regional court). Administrative proceedings are regulated by the Code of Administrative Procedure (Codice del processo amministrativo, Legislative Decree No. 104/2010).↩︎

Specifically, the seats that become vacant are assigned as follows: half to judges from regional courts; a fourth to lawyers with specific competences, public managers, and judges from ordinary appellate courts; a fourth to judges from regional courts, other jurisdictions or public managers appointed after an open competition (Art. 19, Law No. 186/1982).↩︎

The internal organization of the Council of State is mainly regulated by Law No. 186/1982.↩︎

After eight years of seniority (with at least two at the Council of State), Council of State judges are nominated for the office of President of Section within the limits of available seats.↩︎

The Sixth Section has three Presidents as a result of Law No. 205/2000.↩︎

With respect to judges, there is mandatory retirement at seventy (Article 5 of the Legislative Decree no. 511 of 31 May 1946). The law decree n. 90 of 2014 repealed Article 16 of Legislative Decree 30 December 1992, no. 503. This 1992 statute introduced the possibility that all civil servants of the state (including judges) and noneconomic public bodies could remain in service beyond the mandatory age limit for retirement. This extension was envisaged for a maximum of two further years.↩︎

The distribution of competences among the judicial sections is determined at the beginning of each year by the President of the Council of State, after consulting the Council of the Presidency (Art. 1, Law No. 186/1982, as amended in 2008). At the starting point of our research, the activity of the Sixth Section related to these subjects: Ministry of Economic Development (except for telecommunications); Ministry of the Environment and Protection of Land and Sea; Ministry of Labor and Social Policies; Ministry of Education, Universities and Research; Ministry of Cultural Heritage and Activities; Independent Authorities; Regions; the autonomous Provinces of Trento and Bolzano-Bozen; local authorities; social security and welfare bodies (INPS - Istituto Nazionale della Previdenza Sociale and INPDAP - Istituto Nazionale di Previdenza per i Dipendenti dell'Amministrazione Pubblica).↩︎

Previous studies on supreme administrative courts in Europe include Garoupa et al. (2012). There are also many economic studies about the choice between alternative dispute resolution and court resolution. However, the determinants of alternative dispute resolution are not the focus of our analysis.↩︎

According to confidential information we received from a former judge at a regional administrative court, big law firms had the “necessary contractual power” and influence to effectively choose the chairperson of arbitration panels.↩︎

“Le sentenze sono la moglie, gli incarichi l'amante,” in Italian. The President of the Council of State in 1992 earned 848 million Italian liras from external tasks as an arbiter, while his annual wage as judge was equal to 245 million. He simply commented on his parallel job as “the legitimate earning of some little money” (“il guadagno legittimo di qualche soldo”). Source: Corriere delle Sera, 2007 and 2008 (one of the most important Italian newspapers).

https://www.corriere.it/cronache/08_agosto_07/arbitrati_giudice_800_euro_stella_3c227bb6-6440-11dd-8c8a-00144f02aabc.shtml; https://www.corriere.it/Primo_Piano/Cronache/2007/03_Marzo/25/stella_beffa_magistrati.shtml.↩︎

The ban on participation in arbitration was the only provision of the Legge Anticorruzione concerning Council of State judges who were in office (art. 1, par. 18, Law No. 190/2012).↩︎

The Legge Anticorruzione was adopted on November 6, and came into force on November 28, 2012. It originated from bill A.S. 2156, which was submitted to the Italian Senate by Justice Minister Angelino Alfano on May 4, 2010, and later absorbed other bills, including A.S. 2168. Specifically, A.S. 2168 was submitted to the Senate on May 7, 2010, by Senator Gianpiero D’Alia and, in Article 27, it provided for a ban for judges from participating in arbitration panels of “any kind and object.”↩︎

See the Appendix for a precise statistical and operational definition of BLFs.↩︎

Although full information on arbitrations is confidential and not available, there are press articles denouncing the rewarding nature of such external tasks.↩︎

This rewarding explanation could in part also reflect socialization between the judges and the lawyers representing BLFs.↩︎

Of course, not all judges necessarily engage in this behavior because judicial preferences concerning participation in ADRs vary (for example, reflecting different trade-offs between labor and leisure) or only a subset of judges possess the appropriate skills to skew decisions.↩︎

The national Anticorruption Authority adopted a resolution on December 10, 2015, specifying that the prohibition does not apply to retired judges.↩︎

See, for example, Table A.3 in Appendix.↩︎

http://online.leggiditalia.it/ (Wolters Kluver N.V.). The date March 1, 2006 was chosen as the starting point for our research because relevant changes involving case assignment to panels occurred in 2005 and for reasons connected to balancing the periods before and after the announcement of the Anti-corruption law of March, 2010 within the selected database.↩︎

Admittedly, this approach is subject to some statistical noise (since the panel decision is not always necessarily the President’s legal position). However, considering the full panel would be less informative and presuppose unanimous decisions.↩︎

Since the Council of Presidency’s 2005 ruling, each panel is formed by five judges: a President, a Rapporteur, and three other designated judges. The panel forms decisions based on a majority vote. Article 76 of the Code of Administrative Procedure regulates the voting procedure of the panel and assigns to the President a key role – the President votes last. The Rapporteur votes first, followed by the other judges in increasing order of seniority, and only after hearing the others’ votes does the President cast his/her vote. Debates within the panel prior to the vote, the voting procedure, and the institutional importance attributed to the prestige of seniority are all factors that contribute to the role of panel Presidents in determining the outcome of cases.↩︎

Among the 59 judges in our sample, 16 (27%) acted as Presidents, and 43 (73%) acted as Rapporteurs. Presidents, however, participated in 38% of the arbitrations in the relevant period of analysis.↩︎

Regarding judges of the Sixth Section of the Council of State, fifty external appointments as arbitrators were authorized from 2000 onwards. Other external activities by administrative judges encompass appointments to specific tasks and positions within Ministries, teaching activities, and evaluation commissions in public examinations. Compared to these other external activities, participation in arbitrations by administrative judges was the most controversial, inasmuch as they could provide judges with sizeable monetary benefits; see Furlan (2012).↩︎

The average success rate of BLFs was gradually increasing before 2010 for both treated and control group of cases, with this trend persisting for the control group of cases even after 2010. This may be evidence of a progressive increase in the clout and dominance of BLFs in Italian administrative litigation.↩︎

At the beginning of each year, the President of the Council establishes the composition of both the advising and judicial sections, according to the criteria determined by the Council of Presidency (Art. 2, Law No. 186/1982 and the decision defining these criteria on February 25, 2005, which specifically aims at ensuring the high mobility of judges both among and within the advising and judicial sections). The following principles apply: i) at the beginning of each year, for every section at least two and no more than four judges are transferred to other sections. In implementing this rule, it is necessary to avoid a too long or too short a stay of judges both in a single section and within either the advising or the judicial sections; ii) in any case, the maximum term of a judge within a single section must not exceed ten years.↩︎

These provisions should be read in conjunction with the high rate of mobility of judges both within the different sections of the Council and to other courts (especially the regional courts), which is also the result of specific regulatory provisions aimed at avoiding too long a stay of judges in a single section. In the period of our observations, six judges moved from other sections of the Council to the Sixth Section, nine made the opposite movement, twelve newly appointed judges entered the Sixth Section, and ten judges left this section and the Council at the same time (Table A.2 in Appendix).↩︎

To further assess the random assignment of cases to panels we set up an F-test to check whether there are aspects that significantly contribute to the assignment of cases to either the treatment or the control group. To this purpose, we ran a regression using the dummy treated as a dependent variable, and a broad set of covariates as explanatory factors, excluding judges’ appointment in arbitration and success rates accorded to the BLFs. The F-statistic obtained (F(46, 688) = 1.05) indicates that the covariates are jointly non-significant in explaining the assignment of cases to the treatment.↩︎

Full set of results using alternative clustering approaches is available upon request.↩︎

See, for example, Jia and Nie (2017) for an analogous empirical strategy in the implementation of the difference-in-differences approach in a non-legal context.↩︎

All p-values are smaller than 0.001.↩︎

The soliciting variable \({\overline{BLFwin}}_{it - 1}\) is computed as a running mean of the variable \({BLFwin}_{it}\) in the 12 months previous to the observation date.↩︎